Wegovy costs $1.3m to prevent one heart attack, stroke, or cardiovascular death

Posted on Aug 30, 2023. Updated 11 Nov 2023.

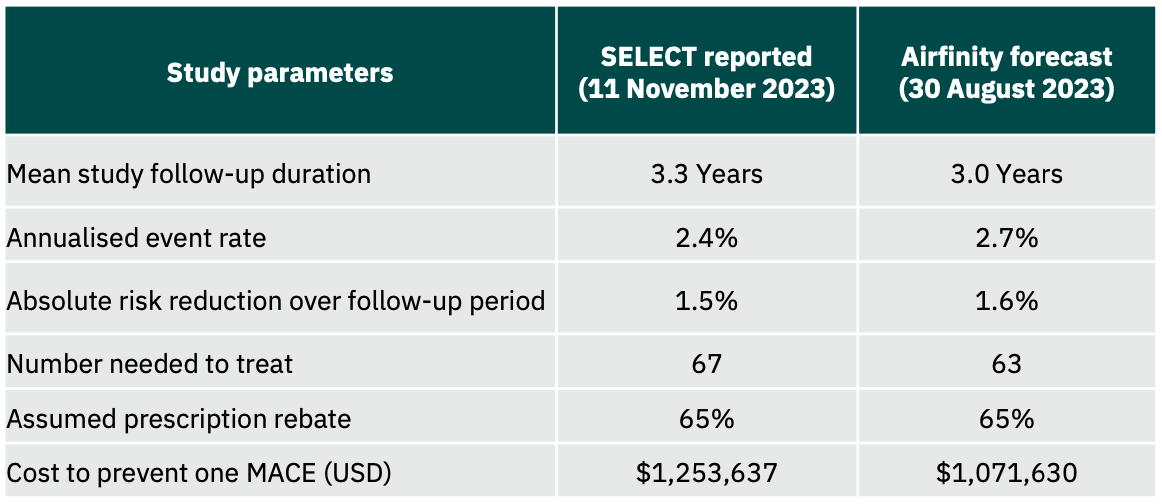

Airfinity has revised its cost effectiveness analysis for Wegovy, increasing the cost of preventing one heart attack, stroke or cardio vascular death from $1.1m to $1.3m.

The revised estimate follows the publication of full clinical data from the SELECT cardiovascular outcomes trial at the AHA conference in November 2023.

Original Press Release:

Airfinity analysis on data from the Wegovy trial on cardiovascular outcomes reveals that even after a 65% rebate on the list price, it will cost $1.1m to prevent one heart attack, stroke or cardiovascular death.

The SELECT trial found that the drug semaglutide, sold under brand names Wegovy and Ozempic, resulted in a 20% reduction in major adverse cardiovascular events (MACE) in the enrolled population.

Airfinity has used data on known SELECT trial recruitment numbers (17,604 participants), a reported 20% reduction in risk, and a total of 1,270 reported events. Airfinity estimates a 2.7% annualised event rate in the placebo arm, and a 3-year average trial follow-up duration based on reported enrolment times. Over this period, Airfinity calculates that 63 patients will need to be treated with semaglutide over a 3-year duration to prevent one heart attack, stroke, or cardiovascular death.

Weekly shots of Wegovy cost $1,350 a month. Airfinity has estimated a probable rebate on the list price to be 65%. Despite this, the treatment cost for 63 patients over three years to prevent one heart attack, stroke, or cardiovascular death is expected to be about $1.1 million. This suggests that commercial payers may continue to resist approving semaglutide treatment for cardiovascular risk reduction even to patients who will likely benefit from it.

US Coverage Scenarios

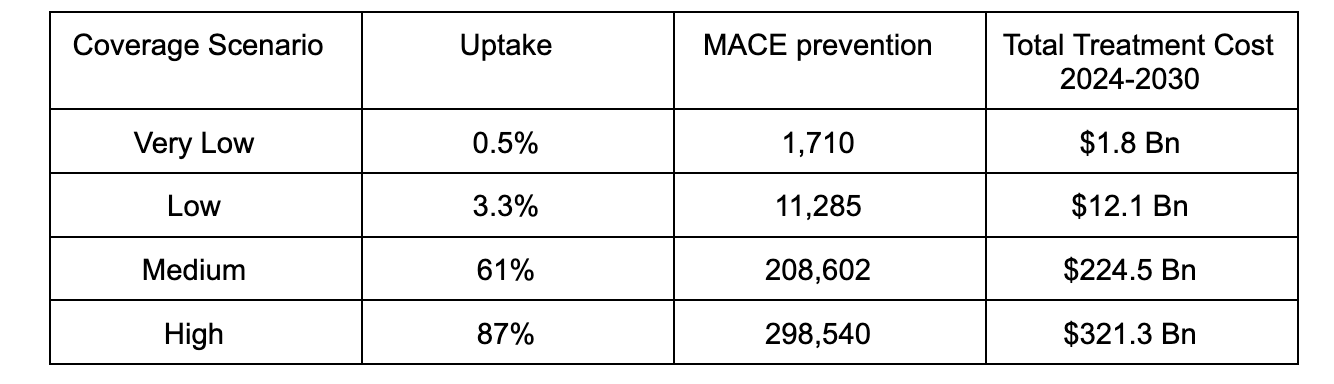

Airfinity estimates that a potential 9.5 to 11.5 million people in the US would be eligible for semaglutide treatment for cardiovascular risk reduction between 2024 and 2030, based on the inclusion criteria for the SELECT trial. The baseline number of MACEs that this population is forecast to experience up to 2030 is about 1.7 million. However, not all of them are likely to have access to the drug. Four coverage scenarios for semaglutide in the US have been used in the analysis below.

The very low coverage scenario is based on the real world uptake of PCSK9 inhibitors when they were launched. Two of these drugs, evolocumab (Repatha) and alirocumab (Praluent), have proven a similar risk reduction on top of standard of care, and launched at a similar price. The low coverage scenario is also based on the uptake of PCSK9 inhibitors after its list price was reduced by 60%.

The medium scenario uses estimated coverage rates of SGLT2 inhibitors as a proxy. These drugs constitute another class of antidiabetic drugs that have shown benefit beyond diabetes, including heart failure and chronic kidney disease, but not obesity. The high coverage scenario is based on the usage of statin therapy in the SELECT trial enrolled population.

Airfinity’s Senior Director of Cardiometabolic Disease, Dr Bhaskar Bhushan, says, “The high price tag of semaglutide is going to hinder wider usage of the drug as insurers and government health providers will remain reluctant to shoulder the costs for large population groups.

“The key will be targeting the drug at a smaller highest-risk population group in which its benefits are likely to be much more cost effective. Insurers and other payers will also be more likely to approve treatment in such high-risk patients, such as those with combined coronary and peripheral arterial disease.

“It is important to note, however, that the beneficial effects of semaglutide are not likely going to be limited to MACE reduction, as weight loss is known to have long term benefits on the risk of a multitude of cardiovascular, renal, and metabolic diseases such as reducing risk of developing diabetes, heart failure, chronic kidney disease, and hypertension. Therefore, the drug's impact on MACE in the SELECT trial is only part of the picture".