Elderly RSV vaccines to generate $10.5B annually by 2030 in G7 countries

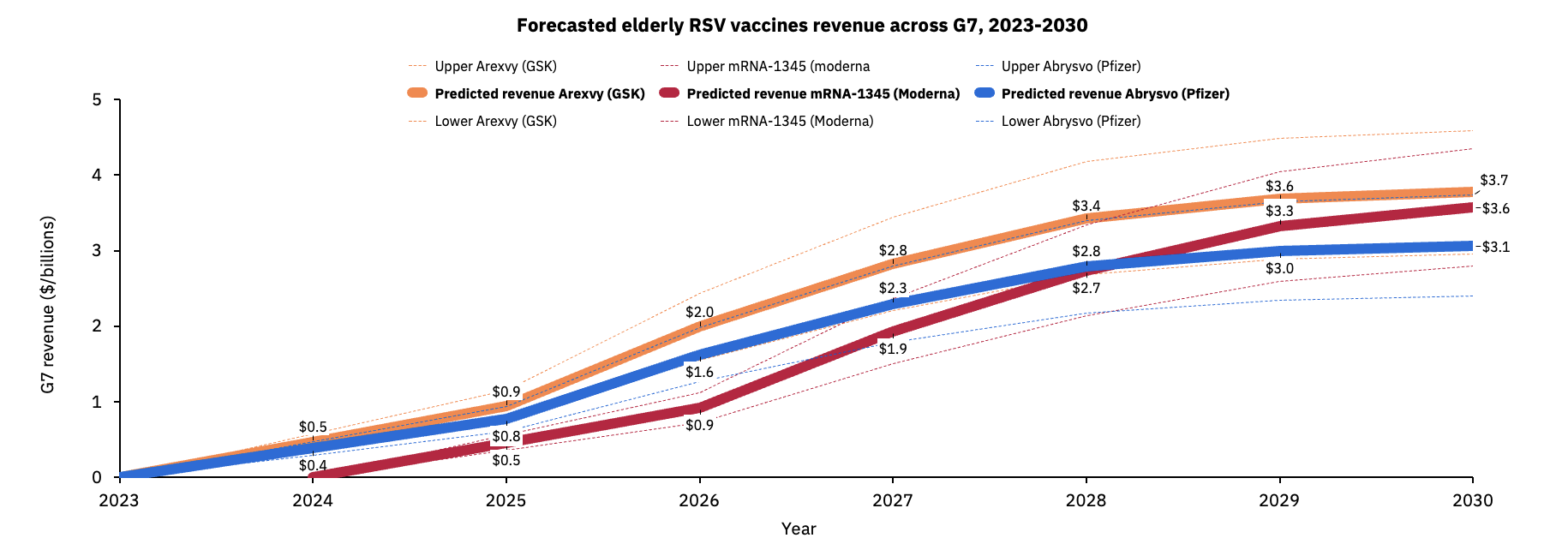

Airfinity forecasts the market for elderly RSV vaccines in the G7 to make $900m this year and reach $10.5B a year by the end of the decade.

Respiratory syncytial virus (RSV) causes infections of the lungs and respiratory tract and can be dangerous for elderly people and infants. Each year, it is estimated that between 60,000-160,000 older adults in the United States are hospitalized and 6,000-10,000 die due to RSV infection.

For the first time, not one but two RSV vaccines are due to launch in the US and UK, with rollout scheduled to begin this autumn/winter.

GSK’s elderly vaccine, Arexvy, is expected to be the market leader taking 56% market share this year generating sales of $500m, with Pfizer’s vaccine Abrysvo taking the remaining 44% and generating $400m.

GSK’s Arexvy is predicted to maintain its position as market leader this decade due to its higher efficacy and being the first approved elderly RSV vaccine across the US, Canada, UK and EU.

However Moderna’s candidate mRNA-1345 is forecast to gain market share from both GSK and Pfizer, with Moderna’s vaccine sales expected to surpass Pfizers in the years to come despite its later entrance to the market.

By 2030, Airfinity forecasts GSK’s Arexvy to generate $3.7B annually, with Moderna’s mRNA-1345 making $3.6B and Pfizer’s Abrysvo taking in yearly sales of $3.1B.

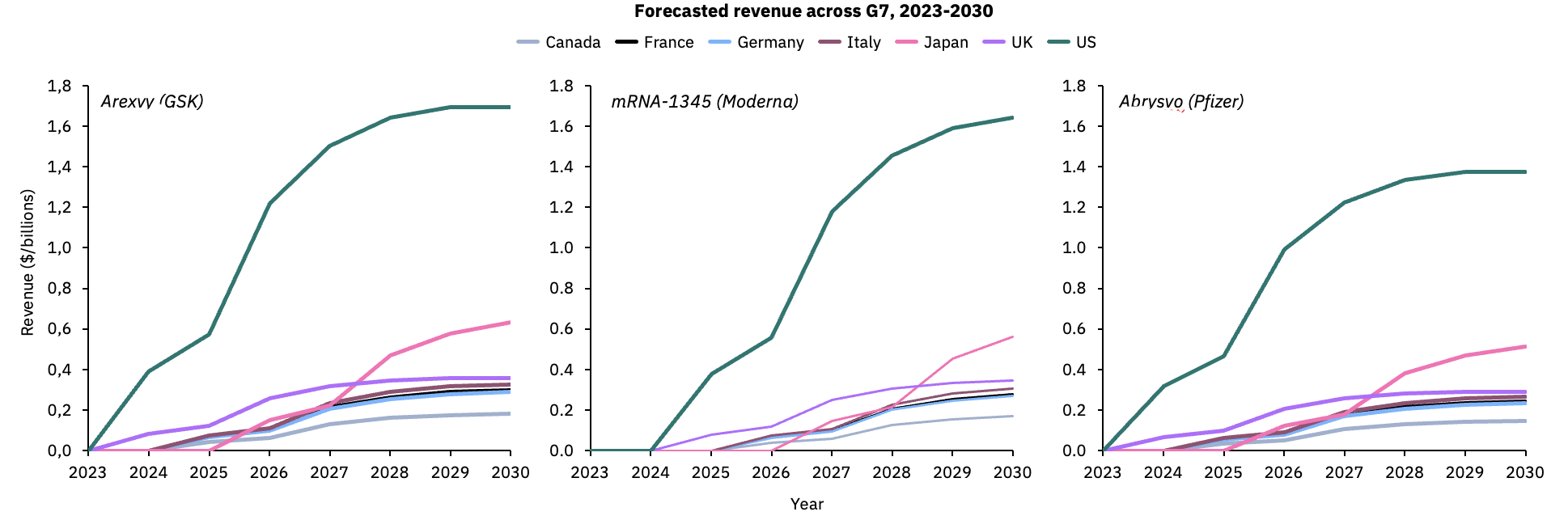

Based on Airfinity’s modeling on RSV vaccine demand, the United States is estimated to yield the highest revenue among the G7 nations with 45% of total sales.

The US and UK are expecting to start vaccine rollout this 2023/2024 season; all other countries will rollout the following year except Japan, which may start rollout in 2026. However, based on forecasted coverage, vaccine revenues in Japan could surpass other countries within three years of launch by 2028.

Airfinity’s Health Economist Salvini Datta says, “With two new approved vaccines to protect the elderly and a new antibody drug approved for infants, this year is set to be a game changer in the battle against RSV and should reduce the burden on healthcare systems.

“Country-level vaccine rollout and uptake won’t happen overnight and our modeling estimates coverage will grow over the next seven years before plateauing. Growth in uptake will be largely dependent on accessibility and the success of public health campaigns to educate vulnerable people on the need and benefit of vaccinating against the virus.

“We expect GSK, Pfizer and Moderna’s vaccine will dominate the market for the foreseeable future until potential combination shots targeting COVID, flu and RSV progress to approval”.