COVID-19 vaccine makers raise prices to off set falling revenue as demand for jabs drops

COVID-19 vaccine makers raise prices to off set falling revenue as demand for jabs drops

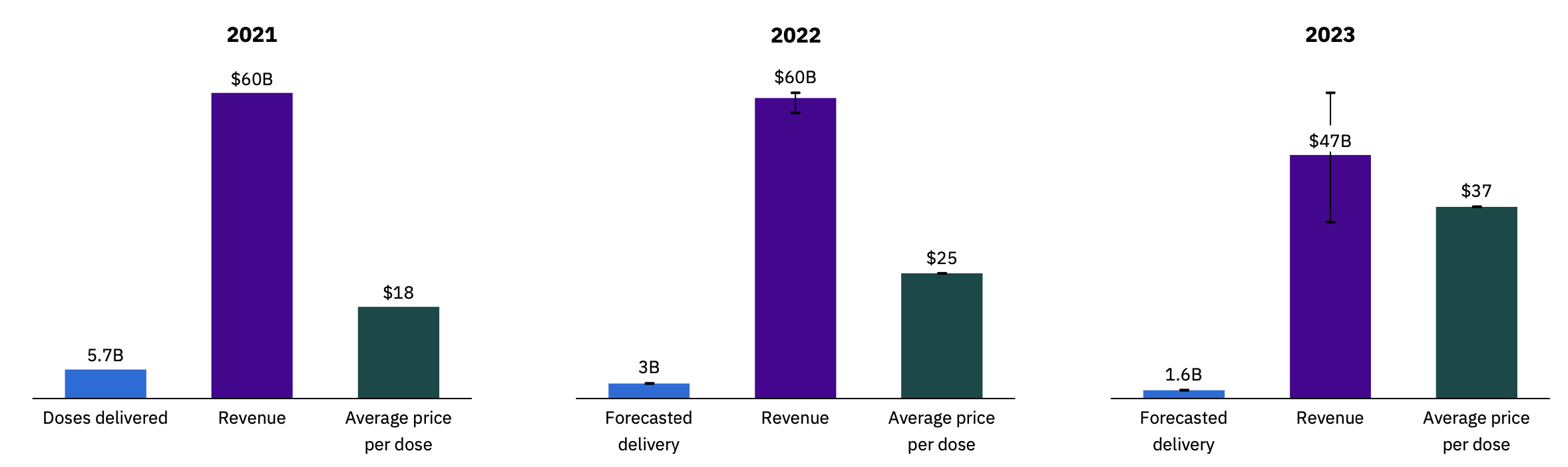

Airfinity forecasts the COVID-19 vaccine market will generate $60bn in global sales this year, broadly the same as last year. This is despite the number of doses sold dropping from 5.7 billion in 2021 to an estimated 3 billion this year.

The value of the COVID-19 vaccine market is predicted to fall by about a fifth to $47bn next year. Our modeling for 2023 predicts the number of doses sold will fall further to 1.6 billion doses as the world enters a new endemic era with the virus.

Despite the drop in sales volumes of 72% between 2021 and 2023, revenue is only predicted to fall by 22% due to higher prices. Airfinity’s analysis shows the average price per dose will double from $18 in 2021 to $37 in 2023.

Observed and forecasted COVID-19 vaccine deliveries, prices per dose and revenue over time

Pfizer and Moderna are predicted to maintain dominance of the market, with 94% market share in 2023.

Revenues are predicted to fall from $37bn for Pfizer/BioNTech in 2021, to $32bn this year and next. Moderna is forecast to see sales up this year from $17bn in 2021 to $21bn but drop to $12bn in 2023.

All manufacturers are raising prices but the mRNA vaccines have gone up the most. A dose of Pfizer/BioNTech is expected to cost between $22 - $42, depending on which country is purchasing.

Moderna is estimated to be selling vials for between $32 - $50 with the United States potentially paying even more. Moderna indicated that the potential prices in the US market could range from $64 to $100 per dose. Meanwhile shots from the other vaccine manufacturers, AstraZeneca, Johnson & Johnson and Novavax, are estimated to cost between $5 - $16.

New vaccines entering the market are not expected to gain significant market share in 2023. The Novavax COVID-19 vaccine was approved by the EMA in December last year. It is forecast to generate $2.3bn this year, taking almost 4% market share. However this is expected to fall to 1.7% market share in 2023. Other new candidates from Sanofi/GSK and HIPRA are expected to see similar levels of success.

Next year is set to see the emergence of a private market for COVID-19 vaccines, most prominently in the United States. Airfinity’s analysis of G7 and EU supply deals shows all countries except the US have secured supply which will exceed population demand. So far, there haven’t been any publicly disclosed orders on the private market in the US, but these are expected to start in the second half of 2023.

Airfinity’s CEO Rasmus Bech Hansen says: “These numbers show a persistent and longer term demand for COVID-19 vaccines and illustrates that COVID-19 is a continued large health threat and significant disease burden. It’s also a clear sign that the vaccine market has been completely transformed by the pandemic and we can expect continued significant innovation in the space.”

Airfinity’s Analytics Director Dr Matt Linley says, “President Biden’s announcement that the pandemic is over will aid manufacturers to raise the price of COVID-19 vaccines to non-pandemic levels, therefore supporting future revenue to be kept at a stable level though supply could be lower compared to previous years.

“Pfizer/BioNTech and Moderna are continuing to benefit from first to market advantage and will continue to dominate the market for the foreseeable future. The duos’ new variant targeting jabs are set to cement this status. mRNA technology has proven to be the quickest to update for new variants of concern and therefore demand higher prices.”