Sales of COVID-19 antiviral pill Paxlovid to leap frog Merck’s competitor Molnupiravir

Pfizer’s antiviral pill Paxlovid is expected to have increased sales revenue by 530% from $1.5bn to $9.3bn in the second quarter.

Merck’s tablet Molnupiravir is forecast to see revenue drop from $3.3bn in the first quarter to $1.3bn in the second quarter.

Airfinity’s latest revenue forecast for COVID-19 antivirals shows the greater availability of Paxlovid may have driven down demand for Molnupiravir.

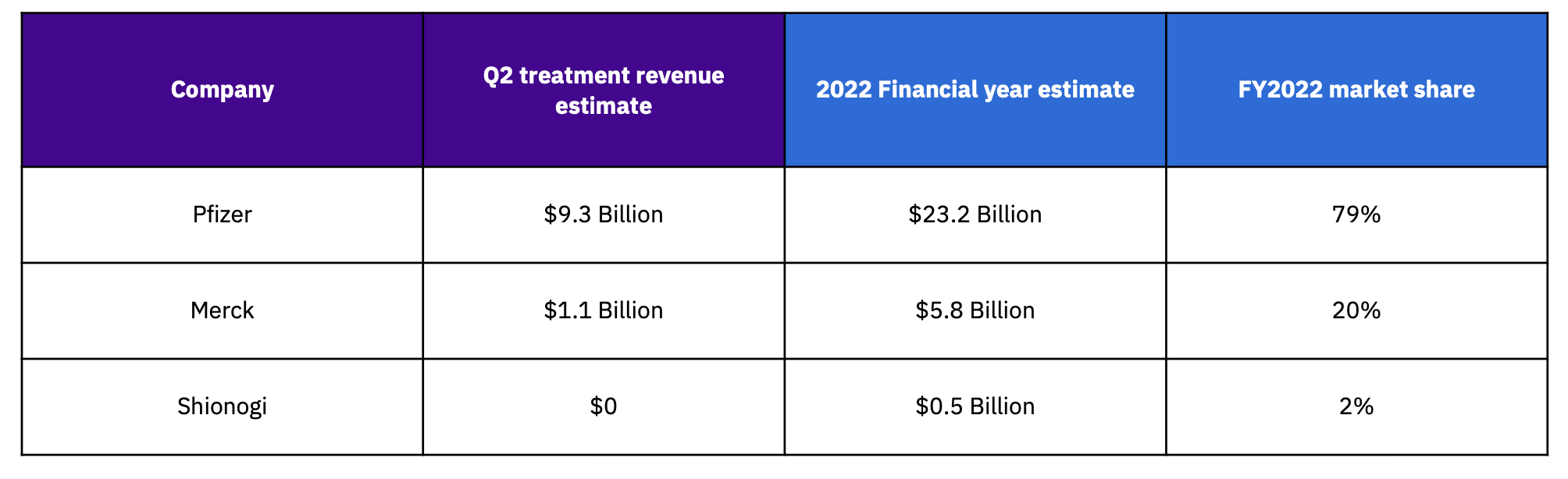

Pfizer’s Paxlovid is predicted to dominate the antiviral market with sales of $23.2bn, taking 79% of market share. However sales growth is forecast to slow in the second half of 2022 and data already shows the pace of new supply deals dropping in recent months.

Stellar sales in Q2 have been offset by lower than expected uptake of the treatment in high income countries. With fewer patients being prescribed the treatment, due to difficulties in both distribution and identifying high-risk individuals, stock available under the current supply deals is expected to last longer.

Pfizer has said it can produce up to 120mn courses of Paxlovid this year but our data shows only 50mn of this has been sold under current supply agreements. Merck plans to produce 30mn courses of Molnupiravir by the end of the year but demand is forecast at half this level.

Airfinity has also revised down its forecast for total market size by 9% to $29.5bn for 2022. The adjustment is largely due to delays in the expected approval of Shionogi’s oral antiviral candidate S-217622 in Japan.

Shinogoi’s treatment was previously forecast to generate $2.5bn this year, this estimate has now been adjusted downwards to $500mn.

Airfinity’s COVID-19 Treatments Analyst Harry Cheeld says, “Merck was first out of the blocks with Molnupiravir late last year, it had stock ready to be delivered and therefore took early competitive advantage. Pfizer has since rapidly scaled up production of Paxlovid, which is a significantly more efficacious treatment. It is now the top choice oral antiviral in the market.

“We expect Pfizer to dominate the market now, with very few new sales forecast for Merck’s tablet. However, despite an open field for Paxlovid, it’s sales growth is likely to be held back by the poor uptake levels we are currently seeing in many countries. Slow uptake will reduce the number of repeat purchases as countries are unlikely to run low on stock in 2022.”

To request our full Q2 COVID-19 Treatments Revenue Forecast, get in touch here.